Ready To Launch Your Portfolio

Into The Future Of Finance?

For accredited investors only. To qualify for access,

you will need to provide verifiable documentation.

An actively managed long/short cryptocurrency hedge fund.

The fund was built to provide actively managed exposure to cryptocurrency assets. The fund aims to outperform both bitcoin and the crypto 100 index with the intention of achieving long term capital appreciation.

The investment team employs an actively managed investment strategy driven by fundamental and quantitative analysis. We seek to generate alpha in two main ways, namely assets selection and market-timing. Through appropriate asset selection the fund will hold long positions on assets expected to outperform the general market and short positions on assets expected to underperform. Through appropriate market-timing the fund will increase allocations to cryptocurrencies during market uptrends and conversely increase the allocation to cash and stablecoins during market downtrends.

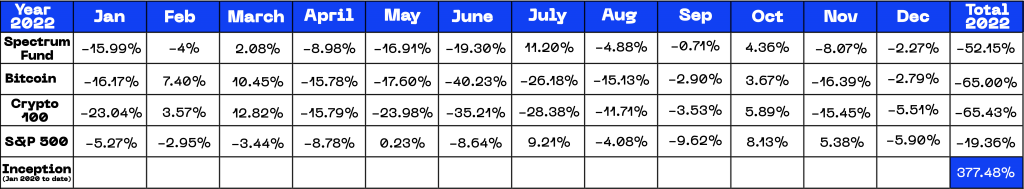

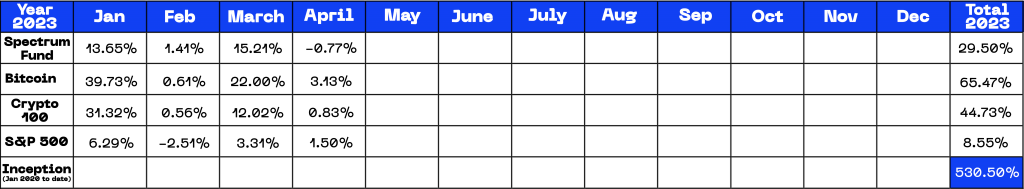

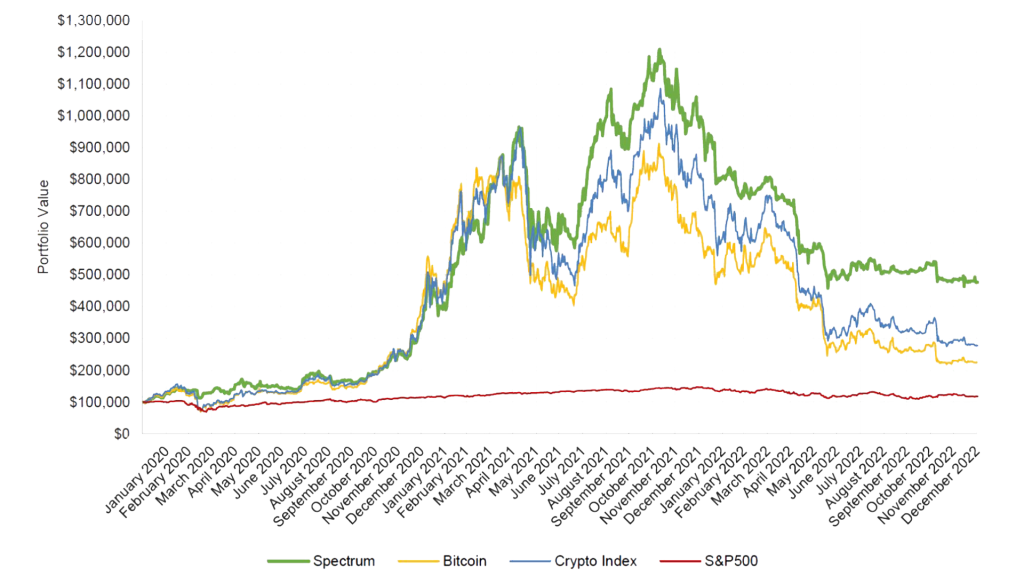

$100,000 invested in Our Model Portfolio at inception returned a value of ($476,763.94) as of December 31st, 2022, compared to a BTCUSD return of ($224,338), Crypto Index return of ($278,404) and S&P 500 return of ($117,718).

The Model Portfolio performance displayed is net of management and performance fees. The performance was achieved based on live trading within a segregated account.

Minimum Investment:

$50,000.00

Investor Type:

Accredited Investor

Management Fee:

2% Per Annum

Performance Fee:

20% annually

Subscription:

Monthly

Redemptions:

Monthly

Lock-up Period:

None

For accredited investors only. To qualify for access,

you will need to provide verifiable documentation.

Our Administration team will send you an email from [email protected] within next 24 hours for you to create your account and get access to our online boarding system.